Investment Options

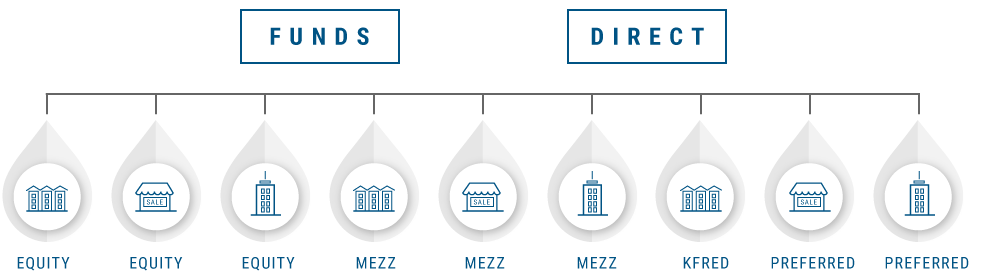

HGI offers investors a choice of investing directly or via funds in real estate properties - including multifamily units, office buildings and retail centers - and in alternative investments. The objective of each of HGI’s real estate funds is to provide investors with a diversified portfolio that generates stable current income returns with the opportunity for long-term capital appreciation.

MULTIFAMILY

MEZZANINE/PREFERRED EQUITY

FREDDIE MAC BONDS

About HGI

Harbor Group International (HGI) is a leading global real estate investment and management firm. With $19 billion1 in real estate investment properties, the firm invests in and manages diversified property portfolios including office, retail, and multifamily properties. With over 39 years of experience in the industry and approximately 1,400 employees worldwide, HGI continues to look for real estate investment opportunities.

Media Coverage

Recent Press Releases

Harbor Group International controls $19 billion1 in real estate investments and is constantly exploring real estate investment opportunities in the worldwide market.

Harbor Group International, LLC provides real estate management and real estate investment services and is not affiliated with Harbour Group Industries, Inc. (whose web site may be found at www.HarbourGroup.com), which offers investment services in connection with the acquisition, development and operation of industrial and manufacturing companies.

1Total capitalized value of underlying assets of $19 billion includes direct real estate and private funds as of 3/31/2024. AUM represents the total capitalized value of underlying assets, which includes direct and indirect real estate and real estate related investments, and the AUM of HGI’s affiliate, HGI Capital Management, LLC.